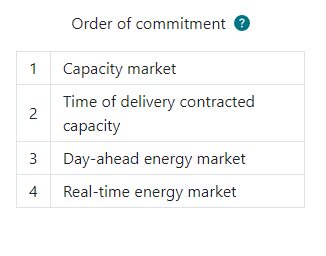

An Energy Market offers financial compensation for the power sold to the wholesale merchant market from which a project may buy or sell electricity, unless a restriction on buying from the grid is specified. You may select multiple revenue streams and restrict battery state of charge bounds in order to reserve capacity (%) for the operational market. The operational market determines the dispatch and is the last energy market in the Order of Commitment.

HOMER Front will optimize the selected markets separately based on the priority scheduling order. More details can be found here: Multiple Energy Markets.

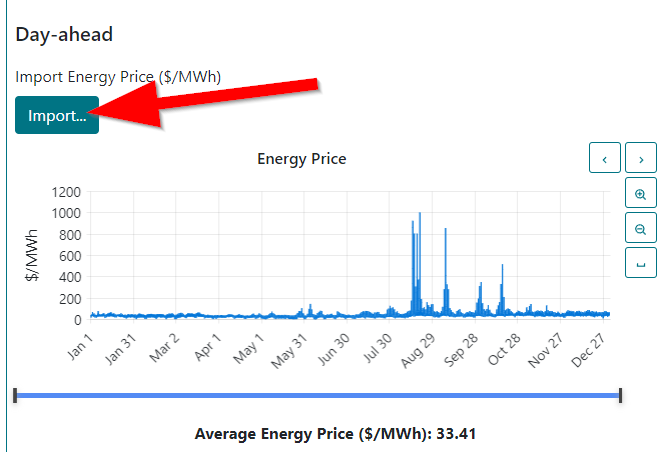

In HOMER Front, you can import Day Ahead Market (DAM), Real-Time Market (RTM), and Fifteen Minute Market (FMM) price strips in $/MWh. (Note: These are the names for California Independent System Operator (CAISO) and may vary based on your region.)

Import

Select Energy Market and click on the drop-down to select one of three options. The window of horizon or foresight is two days, regardless of which energy market name is selected.

Select Import to upload pricing for the selected energy market. See Import formats to view which formats are acceptable.

Tip: You can import data with any time step down to one minute. HOMER detects the time step based on the number of rows in the file. For example, if the data file contains 8760 lines, HOMER assumes it is hourly pricing. If the data file contains 35,040 lines, HOMER assumes it is 15-minute pricing.

Average Energy Price

The average energy price is the arithmetic mean of the imported price signal in $/MWh.

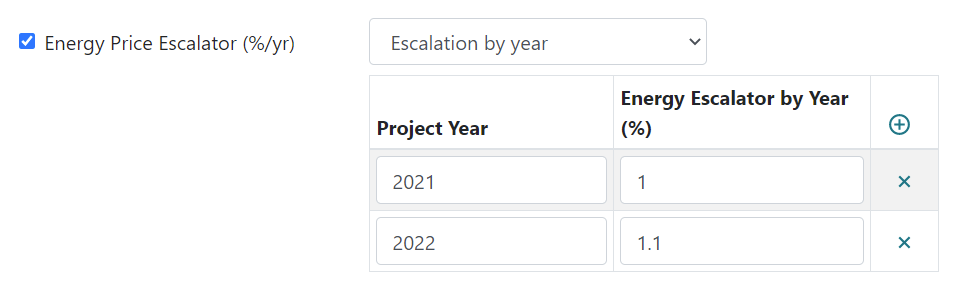

Energy Price Escalator

If you would like to consider changes in price over your project lifetime, click the Energy Price Escalator (%/yr) box. Choose the Linear escalation option in the drop-down to specify %/yr or select the Escalation by year to enter %/yr.

Multiple Energy Markets

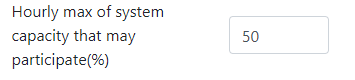

If you are modeling two or more energy markets, specify the hourly max (%) system capacity that may participate in each market. Some of the overall system capacity can be reserved to use in other markets. The last market in the Order of Commitment (or priority scheduling order) is considered the operational dispatching market.

For example, if there are two markets with 50/50 allocation, the first market (Day-ahead energy market) restricts the battery to the range of 25-75% (assuming a minimum SOC of 0%). The final market (Real-time energy market) allows the battery to operate over the full range.

See Also